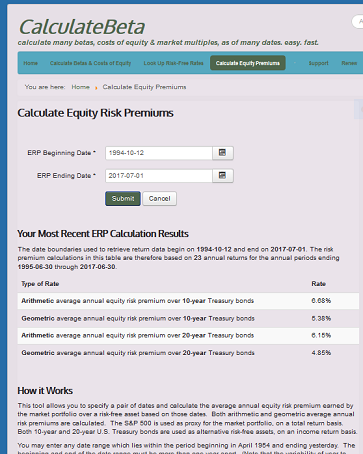

This tool allows you to specify a pair of dates and calculate the average annual equity risk premium earned by the market portfolio over a risk-free asset based on those dates. Both arithmetic and geometric average annual risk premiums are calculated.

You must be registered and logged-in to access this tool. Registration is easy and free.

The S&P 500 is used as proxy for the market portfolio, on a total return basis. Both 10-year and 20-year U.S. Treasury bonds are used as alternative risk-free assets, on an income return basis.